The Ultimate Guide to Mining Pool Fees: How They Affect Your Crypto Profits

When it comes to maximizing your cryptocurrency mining profits, understanding mining pool fees is essential. While mining pools make it easier for miners to earn steady rewards, the fees they charge can significantly impact your bottom line. In this guide, we’ll explain what mining pool fees are, the different types, how they’re calculated, and how to choose the best pool for your needs.

What Are Mining Pool Fees?

Mining pool fees are charges deducted by the pool operator from your mining rewards. These fees are used to maintain the pool’s infrastructure, cover operational costs, and sometimes provide additional services like payout guarantees or advanced analytics. Understanding these fees is crucial for accurately calculating your net mining income.

Types of Mining Pool Fees

- Fixed Percentage Fee: The most common type, usually ranging from 0.5% to 3%. This fee is deducted from your rewards before payout.

- Pay-Per-Share (PPS) Fee: PPS pools often charge higher fees (up to 5%) because they offer stable, predictable payouts regardless of the pool’s luck.

- Pay-Per-Last-N-Shares (PPLNS) Fee: PPLNS pools typically have lower fees (0.5%–2%) since payouts depend on actual blocks found and the pool’s luck.

- Withdrawal Fees: Some pools charge a small fee when you withdraw your earnings to your wallet.

- Hidden Fees: These can include delayed payouts, minimum withdrawal thresholds, or unfavorable exchange rates for auto-conversion.

How Pool Fees Impact Your Mining Profits

Even a small difference in pool fees can add up over time, especially for high-volume miners. For example, a 1% fee on $10,000 in mining rewards means $100 less in your pocket. Always factor in pool fees when calculating your expected ROI and net profit.

How to Compare Mining Pools by Fees

- Check the Official Pool Website: Always verify the fee structure on the pool’s official site or documentation.

- Read User Reviews: Community feedback can reveal hidden fees or payout issues not listed on the website.

- Test with Small Payouts: Try mining with a small amount first to see the actual fees deducted and payout process.

- Consider Total Cost: Don’t just look at the headline fee—consider withdrawal fees, minimums, and any other costs.

Tips to Minimize Pool Fees and Maximize Profits

- Choose Low-Fee Pools: All else being equal, lower fees mean higher profits. But balance this with pool reliability and reputation.

- Look for Promotions: Some pools offer fee discounts for new users or during special events.

- Optimize Withdrawal Frequency: Reduce withdrawal fees by accumulating rewards and withdrawing less frequently.

- Monitor Pool Performance: Sometimes a slightly higher-fee pool with better uptime and luck can be more profitable overall.

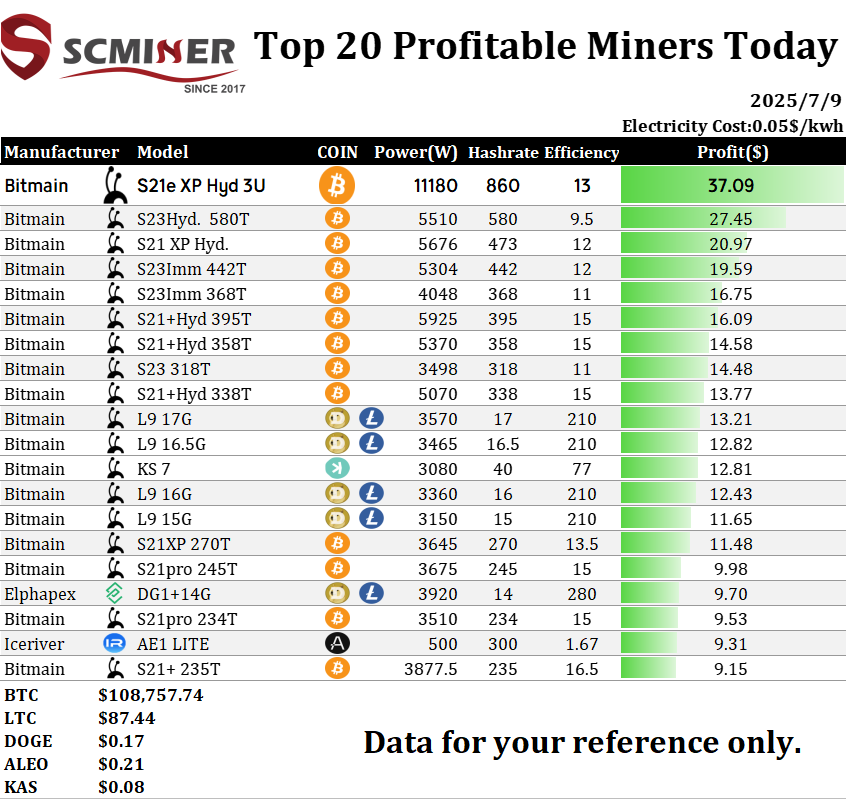

Current Top-Performing ASIC Miners Summary

Below is a summary of the most profitable ASIC miners in the market as of today (Data updated regularly):

Data Notes:

-

•

Profitability is calculated based on current Bitcoin price and network hash rate. -

•

Electricity cost is set at $0.05 per kilowatt-hour. -

•

Data Source: ASIC Miner Value, updated daily.

Note: Mining profitability fluctuates with market conditions. For real-time calculations, use tools like ASIC Miner Value before making a purchase.

Conclusion

Mining pool fees are a critical factor in your overall crypto mining profitability. By understanding the different types of fees, comparing pools carefully, and optimizing your mining strategy, you can keep more of your hard-earned rewards. Always stay informed and regularly review your pool’s fee structure to ensure you’re getting the best possible returns from your mining operation.